Business Insurance in and around Chesterfield

Searching for protection for your business? Look no further than State Farm agent Lane Sander!

Insure your business, intentionally

State Farm Understands Small Businesses.

Small business owners like you have a lot of responsibility. From social media manager to product developer, you do as much as possible each day to make your business a success. Are you a pet groomer, a florist or a home cleaning service? Do you own a pottery shop, a craft store or a bridal shop? Whatever you do, State Farm may have small business insurance to cover it.

Searching for protection for your business? Look no further than State Farm agent Lane Sander!

Insure your business, intentionally

Small Business Insurance You Can Count On

When one is as driven about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for worker’s compensation, commercial auto, business owners policies, and more.

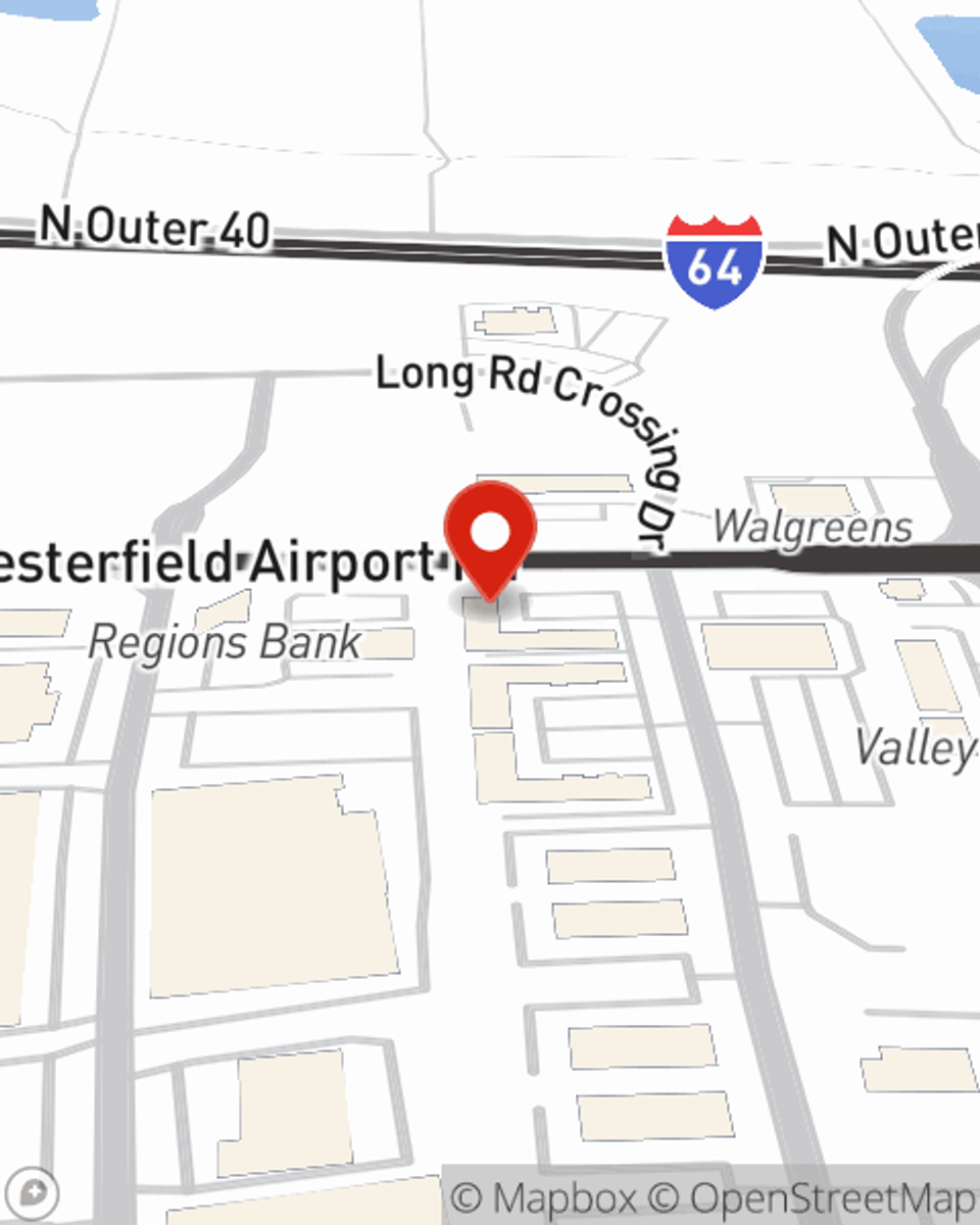

The right coverages can help keep your business safe. Consider getting in touch with State Farm agent Lane Sander's office today to discover your options and get started!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Lane Sander

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.