Condo Insurance in and around Chesterfield

Looking for great condo unitowners insurance in Chesterfield?

State Farm can help you with condo insurance

Home Is Where Your Heart Is

Your condo is your haven. When you want to rest, slow down and chill out, that's where you want to be with your favorite people.

Looking for great condo unitowners insurance in Chesterfield?

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

That’s why you need State Farm Condo Unitowners Insurance. Agent Lane Sander can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Lane Sander, with a hassle-free experience to get high-quality coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Lane Sander can help you file your claim whenever life goes wrong. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Ready to move forward? Agent Lane Sander is also ready to help you discover what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

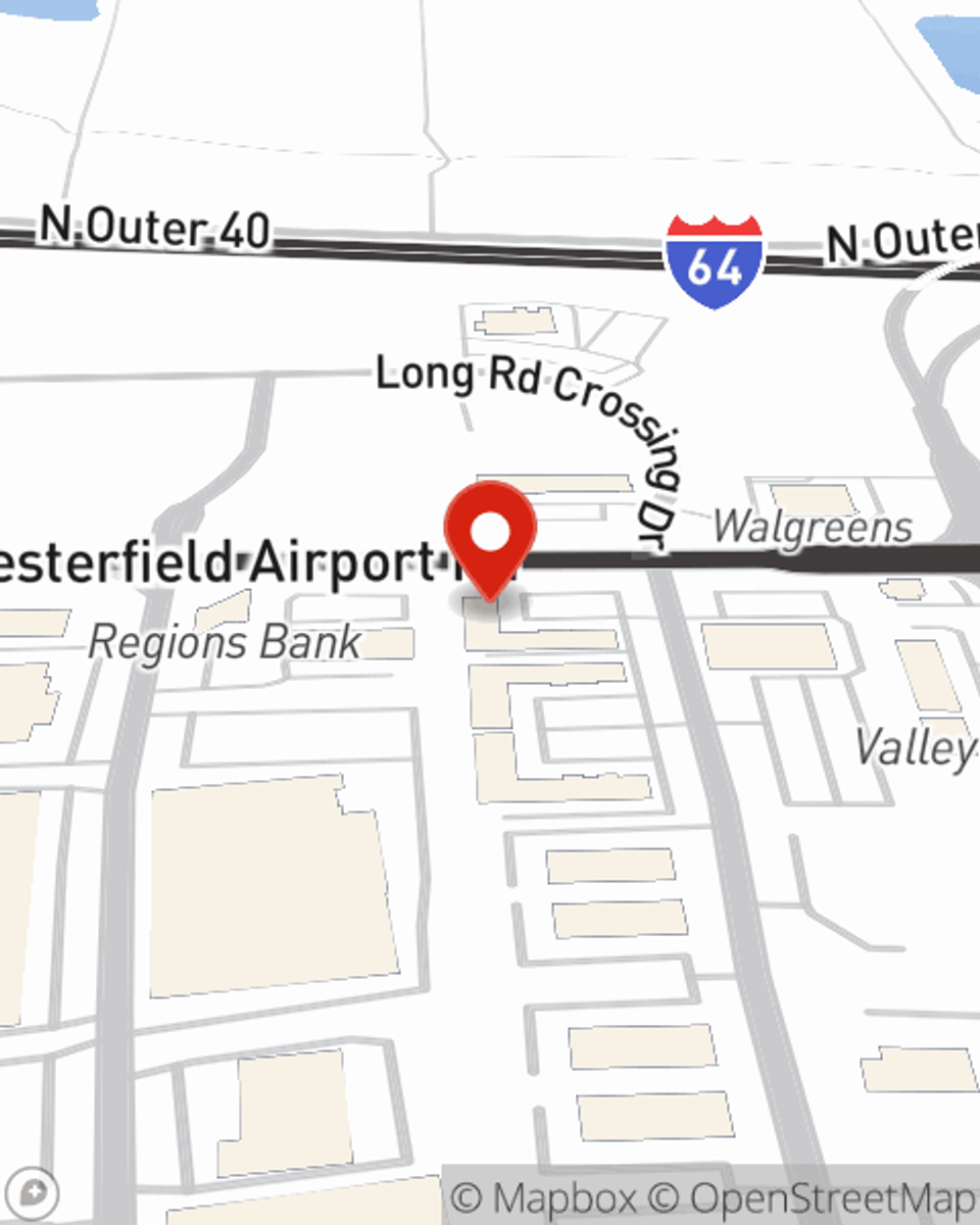

Call Lane at (636) 530-9989 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Lane Sander

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.